The BA Publishes the 2021 Craft Beer Industry Review

Every year, the Brewers Association publishes its Industry Review issue of The New Brewer magazine, which gives craft beer industry members a snapshot of how each brewery segment of the industry has performed over the past year in terms of production and sales levels. This edition never fails to disappoint with a plethora of juicy statistics for beer data nerds to chew on and brewery ownership to postulate about the future of the craft beer market landscape. This year was not without its share of surprises, with the likes of a non-alcoholic beer brand entering the mix and even more appearances by well-known breweries now functioning as “beverage” companies enjoying success with products that go beyond the typical ale or lager. And while that sexy 8% overall segment growth rate gets industry folks all excited, it’s not without some fine print. It’s one thing to take these rankings on the nose and pass judgment on where the craft beer industry is heading, but there are some really interesting finds in this data if you learn to read between the lines.

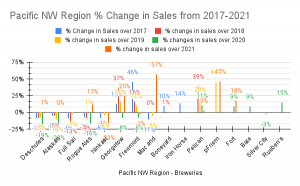

The Pacific and the Pacific Northwest regions of the US craft beer market seem to be the most volatile over the past 5 years. From 2017 to 2022, the top-ranked breweries by sales in BBLs saw only 5 breweries consistently show up each year in their respective top 10 lists. There were over 20 different breweries that have fluctuated in and out of the top 10 rankings since 2017. Notable newcomer Fort George Brewing managed to actually grow during the shutdowns in 2020 and show continued positive growth heading into 2022. Following the West coast folks, the Mountain West region proves to be fertile ground for competition experiencing only 4 breweries with a continuous rank in the top 10 over the past five years, but with 11 other craft beer brands making appearances throughout the same time period. The midwest (North Central region) seems to be the most consistent with a change of only 3 breweries jumping in and out of the top 10 ranks over the past five years and 8 retaining their constant presence.

Down in the South region, 6 craft brewery brands showed up consistently in the top 10 but had to contend with 8 other breweries entering and exiting the top-ranked list. The vital importance of innovation in craft brewing can be seen in the South region rankings with the exit of Abita Brewing from the top 10 over the past 3 years and the meteoric rise of fresh takes from the likes of Creature Comforts Brewing Co and Scofflaw Brewing Co. The Northeast saw a consistent appearance from 7 breweries over the same time period, but with 7 other craft beer brands jumping in and out of the ranks. Most notably entering the mix with a triple-digit-sized exclamation point is Athletic Brewing Company out of Stratford, CT, which is the only nonalcoholic brewery to make these industry rankings since the inception of the BA. For an in-depth look at how the rankings changed over time within each region, CLICK HERE.

So why do some brands stick around and others fall off the list?

In any consumer packaged goods market, brands must be constantly aware of where they fall within their product life cycle phase to appropriately dictate their business plans. Newcomers in the start-up and growth phases are focused on things like building brand awareness and encouraging consumer trial, versus more established brands that find themselves in the maturity or decline phases tend to focus on differentiating themselves from their competitors and reinvention of their brand or products. So while the new folks that enter these lists are brands to keep an eye on, don’t underestimate the usual suspects that consistently rank for growth year after year, which means they are doing some commendable innovation work in a highly competitive craft beer space. It’s in this pocket where we see diversification of product lines and the reinvention of brands that can completely revitalize sales numbers.

Strategic Thinking

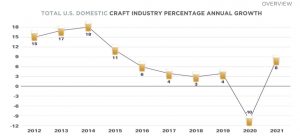

Also glaringly obvious within the comparison of these lists over time is the drastic effect of pandemic era market conditions on the majority of craft beer brands over the past three years. Even the strongest craft breweries struggled during 2020 and even into 2021. The old adage of building a brand in the On-Premise and having sales results carry over into the Off-Premise space was completely turned on its head with the introduction of government shutdowns in the hospitality sector. The monumental sales growth that craft breweries experienced between 2013 and 2019 was obliterated in 2020. And while it’s wonderfully optimistic to acknowledge that the craft beer segment overall has shown 8% growth in 2021, the industry overall has yet to recover to 2019 sales volume levels. The cautionary tale here is that craft brands need to adapt or die. Strategic business mindsets are vital to the future of any craft brewery brand, regardless of its size, as the craft beer industry’s growth overall has been falling since 2014. The mighty can fall and the Davids can rise if they play their cards right. Today’s package-focused retail market is saturated, which means retailers and distributors are looking for any reason to bump brands from valuable warehouse slots, tap lines, and cold boxes. As our craft beer industry enters a new phase of market conditions that no one has ever experienced before, brands must stay vigilant with their strategic business planning in order to differentiate themselves in the market, stay on a course of smart distribution, and innovate according to rapidly changing consumer tastes.

Business Model Trends

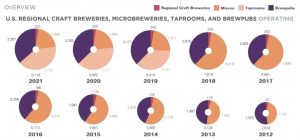

Reviewing the craft beer market overall isn’t complete without also touching on the trends of business models within our industry echo chamber. From 2012 to 2018 there was a consistent presence of regional breweries, microbreweries, and brewpubs, with micros maxing out in 2018 with a jaw-dropping 4,518 functioning entities. But something shifted in 2019 that spurred taprooms all over the US to open at a breakneck speed and we continue to see this trend even today in 2022 after taprooms all over the country had to shutter their doors during the heat of government mandates. And while craft beer taproom opening rates have slowed over the past couple of years, their opening rates are still outpacing the closings, which goes to show to any naysayers that the taproom model is not dead, it’s just harder to maintain than it used to be. Another result of our evolving industry space is the rise of contract brewing. Brewery build-outs and expansions are expensive, and on the flip side, some breweries find themselves in a situation where there is actually excess space for production, so many craft businesses look to contract brewing services as a strategic solution. If you trace the historical production levels of contract brewing over the past two decades you wind up with a U-shaped trend line. Contract brewing enjoyed its time in the sun from 2005 to 2009 but drastically took a nosedive from 2009 until about 2014. Contract brewing production levels are still not even close to what they were back in 2005, but they’re on a steady rise, topping out at over 300,000 BBLs in 2021.

Crystal Ball Predictions

2020 proved that no one, not even Bart Watson of the BA, although he’s our best bet, can accurately predict what will happen in the craft beer space in 2022 and beyond. But what brewery owners and operators can do is follow the data and use strategic planning to guide their business paths. Using this method, a few things are glaringly clear: new brands entering the market are not going to slow down anytime soon; sales will most likely continue their path to returning to 2019 levels and beyond over the next few years; breweries will continue to utilize innovation as their best offense in gaining competitive advantage; consumer tastes will continue to evolve, and advancements in technology will continue to provide creative business solutions for craft beer brands well into the future.

Submit a Comment