Is Craft Beer Recession-Proof?

Yes, but also no. How’s that for a definitive answer? The intricacies of why craft beer dances between recession-proof and recession-resistant are many, but the first step in answering this complex question is to analyze the underbelly of what a recession actually is, how it affects the alcohol industry overall, and what that means for craft brewery owners and operators. Taking a look at factors like consumer behavior, unemployment rates, gas prices, syndicated retail sales data, beer supply, and market seasonality all contribute to how craft beer will fare during times of economic duress. Earning its chops as a multi-billion dollar consumer packaged goods industry over the past decade, craft beer can simply not afford to overlook a downturned economy as something that will not affect bottom lines.

“There’s not much which is totally recession-proof, except maybe bankruptcy lawyers. [Beer’s] not recession-proof, but it’s recession-resistant.”

– Jim Koch, 2009

Recession Defined

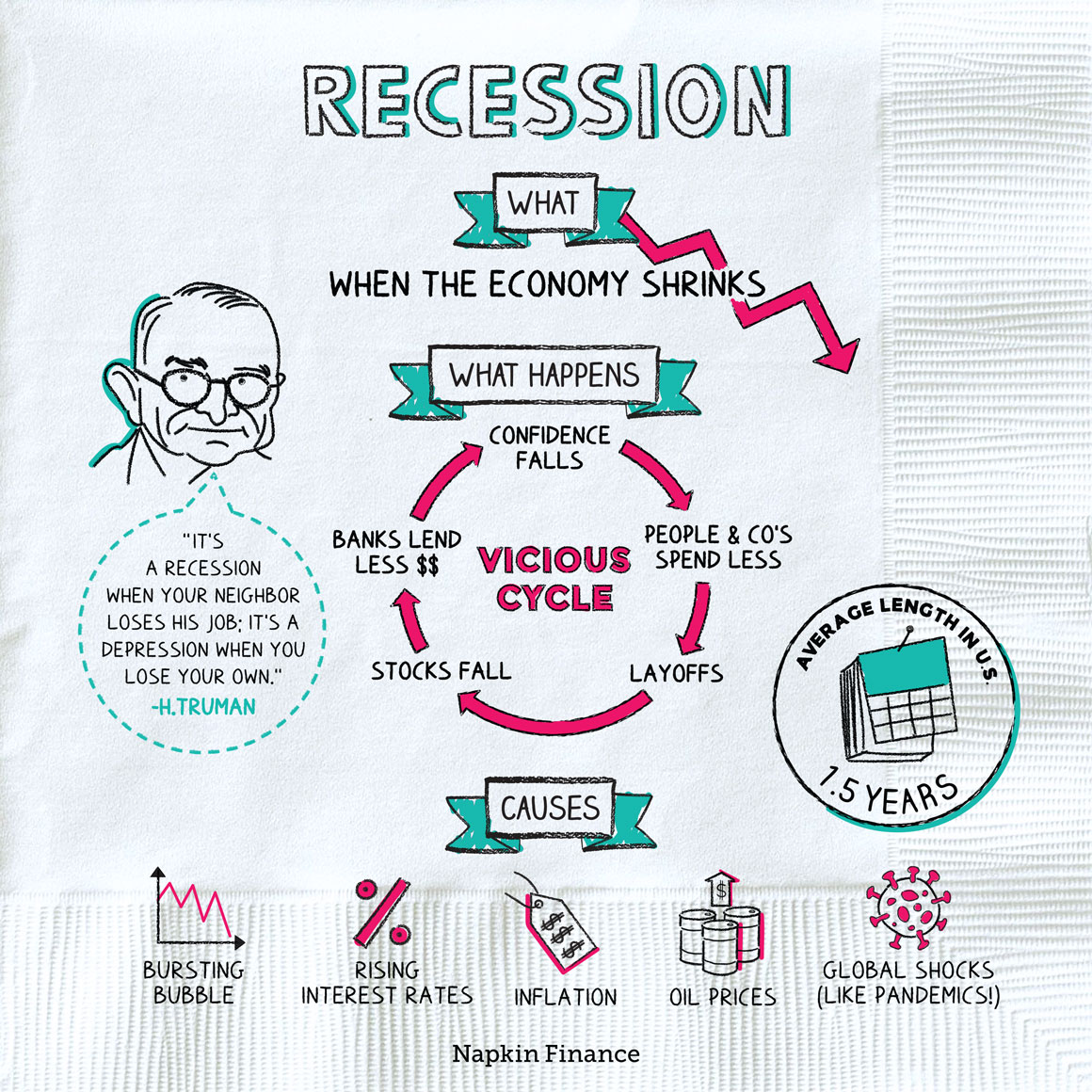

Economics is a bear for many to understand if you’re not actively employed in the industry or formally educated on the subject, so it’s best to keep things oversimplified at first glance. National economies have business cycles, which means that they experience peaks and valleys of expansion and contraction. This is normal and expected. Contractions are also referred to as recessions and produce downswings in employment, output, income, and sales. The vicious cycle of a recession usually includes a decline in consumer demand for products and services, followed by declining retail sales, then reductions in production levels, which results in layoffs, and then comes right back around to a reduction in consumer spending, and so on and so forth. Cue Napkin Finance to help us understand a recession with this simplified visual representation.

Needless to say, consumer spending is affected when the US is experiencing an economic expansion or contraction. Economists have a way to track exactly what types of goods consumers are purchasing depending on the status of our business cycle. Normal goods are things that consumers buy in greater quantities as their income rises, which is applicable to most craft beer brands. Inferior goods are purchased when times are tough, income declines, and consumers are trading down, which usually means they are opting for a more “budget-friendly” brand of beer, so we see a rise in demand for sub-premium beer brands. And finally, there are luxury goods, those brands that are in high demand regardless of what a consumer’s budget looks like –a does 2013 to 2017 ring a bell for any craft beer folks?

Taking goods categorization into mind, saying that beer is “recession-proof” means that it doesn’t matter what the economy looks like, consumers are still drinking, but that’s not always the case. Since there are so many beer brands from which consumers can choose, to get a clear picture of just how resilient beer is, you’ve got to break things down into more specific categories of liquid and address other economic factors, like wage growth, inflation, and shifts in consumer purchasing habits. Yet the biggest challenge facing the craft beer industry at the moment is that there is no clear picture. Sales and consumer purchase habits for craft beer between March 2020 and year-to-date 2022 can only be described as inconsistent at best. While 2021 looked so promising for many owners/operators, 2022 has been an extreme disappointment. Global political unrest, rising gas prices, inflation causing a rise in the cost of raw materials, rising unemployment rates, consumers flip-flopping to FMBs (flavored malt beverages) and RTDs (ready-to-drink cocktails), and supply chain woes have all contributed to nothing short of wacky sales trends that lead to one conclusion about the future of craft beer – expect the unexpected (again). As if all of us didn’t get enough bingo cards filled with unimaginable challenges that the 2019 versions of ourselves wouldn’t have hysterically chortled at in disbelief.

Consumer Spending

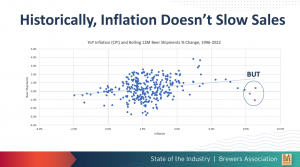

Even when economic times are hardest, consumers are still buying and drinking beer, as Bart Watson of the Brewers Association shows in the recent mid-year update for the craft beer industry. While most in the industry are citing inflation as being the go-to reason as to why sales are lagging this year compared to last year, there is a multitude of other factors that have contributed to the lackluster performance of 2022 so far, including rising prices and low consumer confidence, elevated competition, and declining wages.

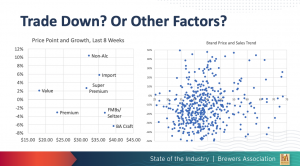

When consumers have less money to spend, they either gravitate towards budget brands or choose brands that give the perception of more “bang for their buck.” This explains why sub-premium beer brand sales are soaring at the moment and that some beer consumers are substituting for spirits. But there’s a flip side to this equation. Consumers that have solid wages and tend to live in higher tax brackets are still partying like it’s 2019. They aren’t phased by recessions and tend to actually purchase more premium brands, more often. This reinforces the fact that the 2022 craft beer consumer profile is a tale of two incomes – each at the opposite end of the economic spectrum.

Another factor that will impact consumer spending is the number of new brands in various alcohol categories that will enter the market by the end of the year. FMBs and RTDs are having their “Not Your Father’s Rootbeer” moment in the sun right now and craft beer brands would be wise to note that since consumers are seeking more value in their beverage choices and are so fickle about variety these days, it’s a distinct possibility that FMBs and RTDs will eat your lunch for quite some time. On August 4th, Brewbound reported that the latest figures from Jefferies showed that spirit-based seltzers had reached 9.1% of the TBA category with brands like High Noon and Diageo’s Ranch Water leading the charge.

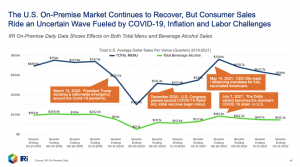

In addition, consumers are drinking at home more often in order to save a little bit more money, so expect to see the Off-Premise sector remain solid until unemployment recedes. There are signs that On-Premise sales are recovering, with rises in check totals and frequency of diners/drinkers on the up, like in this report from Neilsen CGA (August 2022). But operators should realize that things are improving over zero from 2020, so that cute little line chart that shows increasing sales in the On-Premise sector is like being the valedictorian during summer school. All jokes aside, the industry should acknowledge the gains, but it’s a relative data point in the overall big picture.

Ride an Uncertain Wave Fueled by COVID-19, Inflation and Labor Challenges. Data courtesy of IRI

Expectations

To offer up suggestions of expectations for the remainder of 2022 and beyond is about as clear as that Hazy IPA that you just bought last weekend, but there are some current industry trends that can be utilized to ride out the recessionary storm. Since On-Premise sales are continuing to rise, brands should seek to leverage the success of the craft sector in bars, restaurants, and other in-person venues. Sales reps might not see the large volume outputs of pre-2020 within each outlet, but if they are smart about incremental distribution gains, their overall sales levels should see a boost. RTDs don’t pose as much of a threat in the On-Premise, so craft beer brands will continue to thrive in this market environment. Since Off-Premise sales are poised to stay stable or even increase in the months ahead, craft beer brands need to reinforce their territory in retail outlets like liquor stores, specialty grocery, and convenience stores. Large grocery chains are becoming increasingly difficult to work with to secure brand authorizations and with progressive legislation on the rise that could alter RTD taxation and the addition of various beverage formats to grocery store shelves, and chain stores posing new challenges for many craft beer suppliers. Smaller package store outlet sales can be drastically improved with efforts in brand differentiation, store demos, and market activations.

So does this mean suppliers should start brewing sub-premium beers or cranking out big ABV special releases for higher-end market outlets? No, not necessarily, because the US economy is cyclical and innovation is not always fast, but what craft beer folks can do is leverage their most profitable offerings in ways that cater to our current market conditions. And do yourself a favor, start brushing up on economic policy and industry regulation. Big picture-wise, just because craft beer isn’t corporate or mainstream doesn’t mean you get to skip out on evaluating economic factors that will impact your sales. For those craft brands that are seeking a competitive advantage, monitoring US economic conditions should be as commonplace as CIPing your brewhouse.

Submit a Comment