No Big Deal: Why Craft Brewery M&A’s Have Lost Their Shock Value

Goose Island, Bluepoint, Boulevard, Sweetwater, Founders, Wicked Weed, Anchor, Oskar Blues, Lagunitas, Dogfish Head, Ballast Point, Cigar City, Modern Times, Stone, Bell’s, and most recently Avery Brewing – not a comprehensive list by any means, but just a sampling of formerly independent craft breweries that merged with or were acquired by larger parent companies over roughly the past decade. The difference between now and then is that craft brewery M&A’s are just not that big of a deal anymore. Back then, craft beer drinkers and superfans would be up in arms over a buyout or partnership deal of any size – suggesting boycotts, bashing brands online, and protesting festivals where “sellout” breweries would be pouring their liquid. Today, that’s not quite the case, with deals like the Bell’s and New Belgium merger or the acquisition of Avery Brewing by import giant Mahou San Miguel barely sparking a peep of controversy online. So what’s changed – the craft beer fan or the business of craft beer?

Passion vs Profit

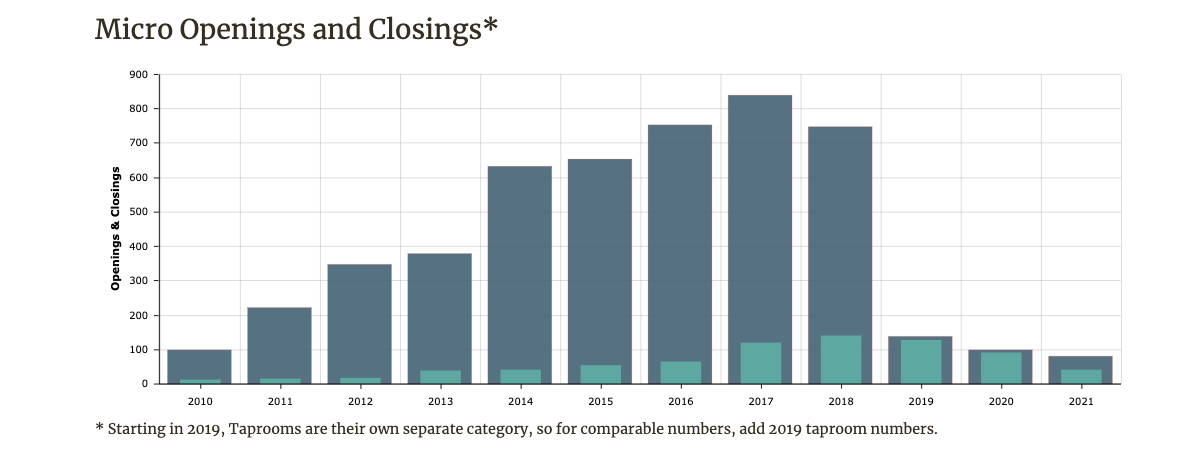

In 1978 then President of the United States Jimmy Carter legalized homebrewing. Hobbyists began tooling around with malt and hop varietals in their garages, kitchens, and spare closets to create delicious concoctions that would reach beyond the historically typical fizzy beverage of the working class. The 1980s brought the likes of Bells, Sierra Nevada and the Boston Beer Company officially making “microbrewing” a legitimate business. In 1996 the US reached 1,000+ microbreweries, marking the tipping point where the opening rate of small, independent “craft” breweries really begins to climb. From 2001 to 2021, the craft brewery count in the US grows from about 1,500 breweries to over 9,000 – a 511% increase – and the industry overall is valued at over $26 billion (Brewers Association 2022). Being the land of opportunity means that a growth curve like this will draw the keen eye of any savvy investor, so it shouldn’t be any surprise that over time craft beer has gone from a passion project to a profit generator. Not a big deal for those that view craft beer as a business, but for the die-hard microbrew fans, turning brews into dollars has been quite the controversial topic, or at least that was the case back in 2011 when AB-InBev purchased Goose Island Brewing. This deal shook the craft beer world to its core and changed the trajectory of the entire industry. Between 2014 and 2017 over 48 craft breweries were either sold to or invested in by large corporate entities, other breweries, or private equity firms, stripping many independent brewers of their “craft” status (Vinepair).

Bang Fizzle

There’s no shortage of passion when it comes to the craft beer industry. Craft beer drinkers have always been different. We’re the scrappy underdogs, the defiant of the status quo. We play with flavors the big beers won’t touch and we bootstrap our businesses to remain fiercely independent. You don’t see that level of passion with other brands in the consumer packaged goods market. You will probably never encounter media headlines or television news coverage for the acquisition of a peanut butter brand or potato chip manufacturer. When a craft brewery goes through a merger or acquisition it used to cause an uprising amongst beer fans that rivaled most collegiate sports matchups. In May 2017 the Chicago Tribune reported about the backlash surrounding the acquisition of North Carolina’s Wicked Weed Brewing by big beer juggernaut AB-InBev. Fans and small business owners were a bit spirited in their response(s):

“Your cowardly embrace of the enemy of craft brewing has made my birthday dinner the other night the last time I will be patronizing your business. If I had known this treachery was in the works I would have picked a more reputable establishment.”

“Sold your soul for cash, thankfully there is enough competition to avoid you completely. thanks for the beers, good riddance.”

So why do fans care so much about buyouts? What’s the big deal? Isn’t America supposed to be the land of opportunity where any underdog can scratch and claw their way up the food chain of capitalism and enjoy financial success? Multiple factors come into play in this situation, from fans citing that the quality of the beer will suffer and that they want to speak with their wallets to support small, independent businesses. All valid points, but the punch of these outcries have fizzled in recent years, with craft beer fans seemingly throwing up their hands and just accepting the natural evolution of craft beer as a business and not just a passion project.

Family of Brands

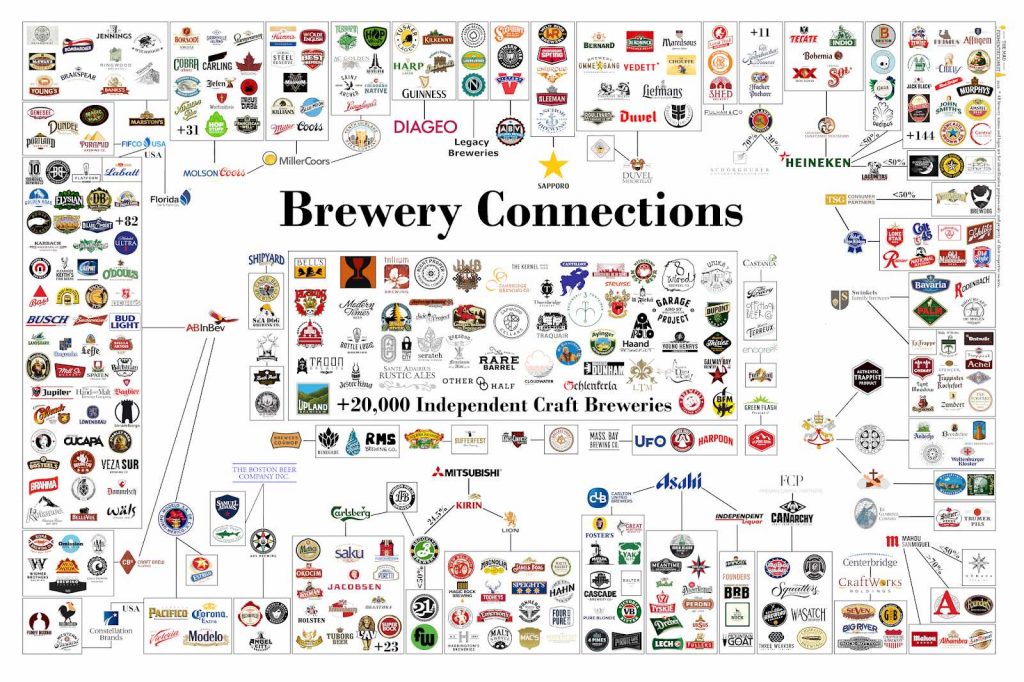

While there is some shock value left in the announcement of a craft beer merger or acquisition, it seems that the path fans now walk is one of acceptance. Craft brands are still underdogs holding only about 13% share of the overall beer market (Brewers Association), but they are definitely playing in larger arenas these days. What’s interesting is that fans are not so quick these days to judge a brand for taking additional capital, merging with a larger company, or signing a deal for a buyout, so either the fans have changed or the industry overall is viewed on par with the rest of the consumer packaged goods world. In 2018 The Mad Fermentationist created a handy chart for the public to use in deciphering the ownership of a brewery at the time (updated in 2019), this image was a bit eye-opening, but over time the public is not whispering about who owns what at the same pace as they did in the late 2010s.

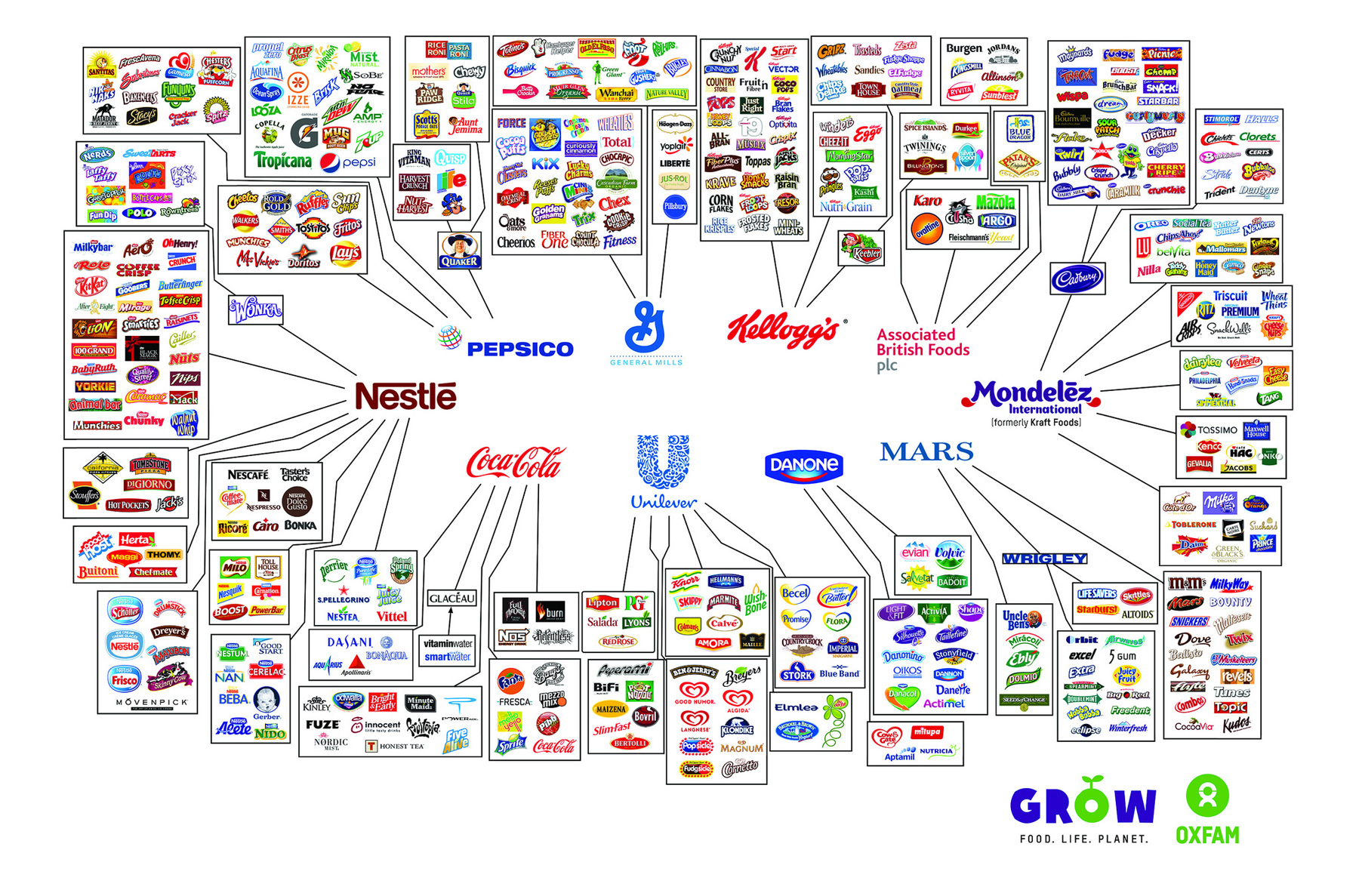

Since then countless articles have been written about the dominance of big beer brands that secretly own the majority of “crafty” brands sold on shelves and behind the bar of most US businesses with alcohol licenses. In 2021 Vinepair reported on stats collected from a study conducted by The Guardian that shows 78% of the overall beer market is controlled by just 4 major alcohol conglomerates. At this rate, this chart of ownership is going to mirror that of the food world sooner rather than later.

So don’t be surprised as the gasps tend to fade as the alcoholic beverage scene continues to evolve adding players like FMBs, RTDs, seltzers, and ciders to the mix. Competition breeds collaboration, so fans should expect a lot more announcements of joint business ventures to grace their inboxes on a consistent basis.

-

It’s all capitalist BS in the end. Abinbev once touted their craft-y division as their #1 growth engine. Recently it’s made cuts in that division after two years of slumping sales, even closing some breweries they bought. I haven’t forgotten those that sold out, their love of money eclipsed their love of the local craft beer scenes from which they benefitted. I still boycott them all. Abinbev has the lawyers to toe the line of monopolistic business practices which influence consumer choice and hurt local independent breweries.

Comments